Should your business use Afterpay? All the pros and cons explained

It is well known within my circle of friends and peers that I am not a fan of Afterpay.

My personal reasons are best saved for a separate blog, but the TL;DR version is because it goes against everything I believe in when it comes to consumerism and developing strong financial habits. I am an accountant, after all.

Accordingly, you will think this blog will be biased. But stop! Before you hit close on your browser, hear me out — I promise to be objective on this one.

Why? Because a lot of our e-commerce clients offer Afterpay and claim it has done wonders for their business. As their accountant and financial advisor, I can attest to that claim. There is no doubt that Afterpay stimulates top-line sales growth.

But at what cost?

In this blog, I’m going to give you an overview of Afterpay, what the costs are and whether your small business should adopt it.

Afterpay is Australia’s fintech darling — a ‘buy-now-pay-later’ platform that allows customers to pay for their purchases over four, fortnightly instalments. Retailers that offer Afterpay get paid immediately, but are charged a merchant fee. It’s like a modern-day credit card with an interest-free period.

Much like other sexy fintech platforms that market to smashed-avocado-eating millennials (cue Spaceship), I want to point out Afterpay is not a new business model. In old-school terms, it’s known as ‘factoring’, where a business sells its accounts receivable to a lender for a fee. The key difference is factoring is typically used for large debtors in B2B companies. Afterpay has brought factoring to consumers (B2C).

Afterpay charges a 4.17% merchant fee on all sales made via the platform. The company also makes money from the customer via late fees.

Afterpay claims the main benefit for retailers is it generates more sales. According to its website, it does this by:

I’ve been unable to dig up any independent statistics on these claims, but it is backed by some case studies listed on Afterpay’s website.

Furthermore, according to a consumer survey by independent finance product website, Mozo, 50% of Afterpay users said they spent more using Afterpay than using a debit or credit card.

The instant gratification monkey is real.

As a rational, profit-driven business owner, the question you need to ask yourself is this: does the 4% merchant cost outweigh the additional sales generated from Afterpay users?

My answer? Well, it depends on three factors:

Let’s tinker with these assumptions.

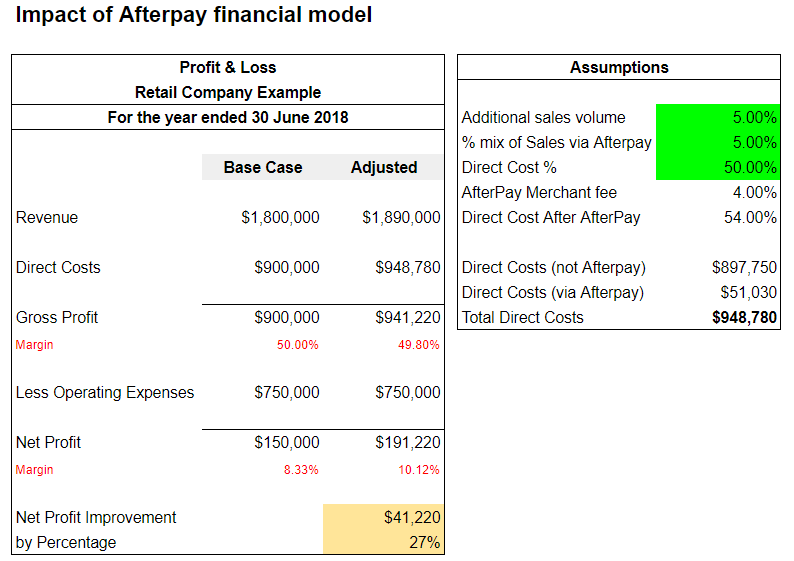

Below is a simple financial model of a retail business. As you can see, there is a base case and an adjusted case, which is driven by the above assumptions.

In this example, we have assumed at a base-case level, the business currently does $150,000 of net profit, assuming a gross profit margin of 50%.

Now, what if the business decided to adopt Afterpay?

Under the adjusted model, we have assumed instant gratification customers spend on average 5% more on every transaction, which results in higher sales. We also assume 5% of total sales are paid via the Afterpay platform. These have an impact on the direct costs of the business, because 5% of total sales attracted the merchant fee of 4%

Factoring the 5% of new sales growth and merchant fee, the business generates an additional $41k of new annual profit. Pretty good right?

Under this example, it’s a no-brainer — you should adopt Afterpay.

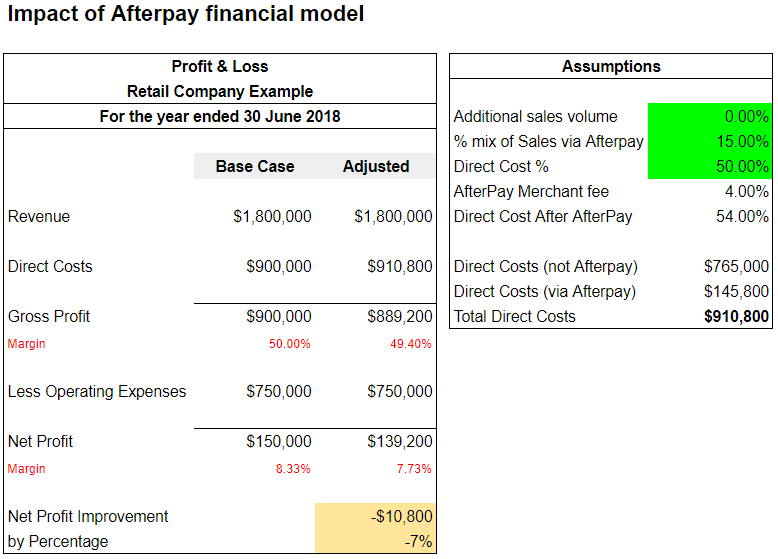

But, what happens when the hype of Afterpay fades away? What if the buzz of Afterpay retail therapy wears off, and your customers go back to their ordinary spending habits. It’s not unreasonable to assume sales volumes will eventually revert to the mean.

The problem here is because your customers are ‘hooked’ on the Afterpay platform, the overall mix of sales paid via Afterpay is higher — which can actually cost you more money if you’re not generating any new sales as a result of the platform.

To model this, let’s play with the assumption no new sales are generated from the base case, but the overall mix of sales paid via Afterpay shifts from 5% to 15%.

As you can see, it’s a very different result. The business is actually worse off.

Why? Because there are no new sales being generated from Afterpay. Furthermore, the sales the customer would ordinarily buy via alternative payments (cash or credit card) is now paid via Afterpay, which attracts a higher merchant fee. The result is that the overall costs of the business increase, with no actual benefit.

Economically speaking, one could argue Afterpay has short-term benefits to your business due to the increased sales volume — but over the long term it may end up eroding your profitability.

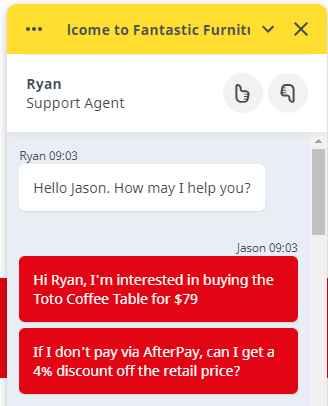

Furthermore, savvy consumers who do not choose to pay you via Afterpay might try to request a discount if they pay via the ‘old-school’ system of cash or credit card. I mean, after all, it saves your business the 4% merchant fee. The net result is the same, so why not pass the 4% fee as a discount to the customer instead of paying it to Afterpay?

Of course, I tried this. My purchase was a To To coffee table from Fantastic Furniture.

Full disclosure, I don’t normally buy furniture — this was for my wife’s Christmas present. If you’re reading this Liz … surprise!

Here’s the chat transcript of my attempted discount negotiation.

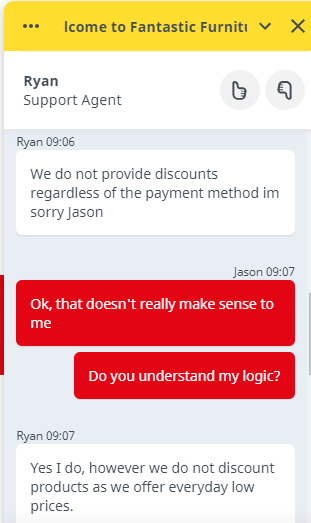

Unfortunately, Ryan couldn’t deliver on the discount due to their store policy (probably above his pay grade). Anyway, it was worth a shot.

It’s highly likely adopting Afterpay is good for your business in the short term. If it indeed does generate more sales, then it’s definitely a win for you. Just keep track of the percentage of sales made via Afterpay so you can understand the long-term impact of it on your business’s profitability.

The risk is your loyal customers simply use Afterpay for everything, which results in cannibalizing existing sales at higher merchant fees for no benefit.

Remember, revenue is vanity, but profit is sanity.

NOW READ: Businesses welcome Afterpay inquiry: Should ‘buy-now-pay-later’ be regulated?

NOW READ: How lending startups like Afterpay make their money